UAE’s $1.4 trillion bet on America: A strategic win for Trump’s economic vision

03/25/2025 / By Willow Tohi

- The UAE has pledged $1.4 trillion to the U.S. economy over the next decade — one of the largest foreign investment commitments in American history — bolstering sectors like AI, semiconductors, energy and manufacturing.

- The deal signals the UAE’s geopolitical alignment with the U.S. under Trump’s leadership, countering global tensions with China and Russia while diversifying the Gulf nation’s oil-dependent economy.

- Major projects include $25 billion for energy/data infrastructure, expansion in natural gas and low-carbon solutions, and a domestic aluminum production boost to strengthen supply chains.

- The investment reflects confidence in Trump’s pro-growth policies (deregulation, tax incentives) and reinforces the “America First” agenda by prioritizing domestic job creation and industrial growth.

- The timing underscores U.S. economic competitiveness against China’s Belt and Road Initiative, positioning America as the top destination for foreign investment despite some undisclosed deal terms.

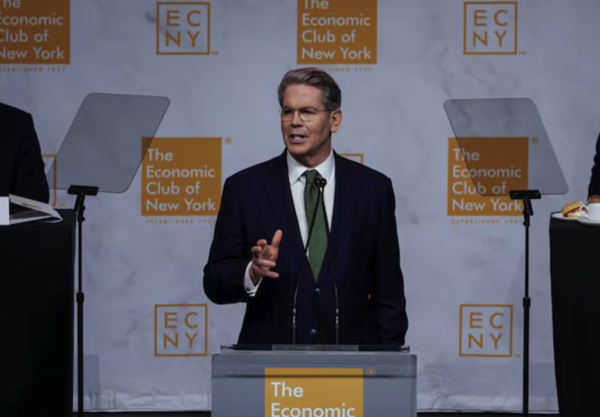

In a landmark announcement that underscores the deepening economic alliance between the United States and the United Arab Emirates (UAE), the White House revealed Friday that the Gulf nation has committed to a staggering $1.4 trillion investment in the U.S. economy over the next decade. The deal, brokered during high-level meetings between President Donald Trump and UAE National Security Adviser Sheikh Tahnoon bin Zayed, marks one of the largest foreign investment pledges in American history—and a resounding validation of Trump’s pro-growth policies.

The UAE’s massive financial injection will target critical sectors, including AI infrastructure, semiconductors, energy and domestic manufacturing, reinforcing America’s industrial base and technological edge. While the Trump administration has disclosed key components of the agreement, some details remain undisclosed — a move likely to fuel speculation about further strategic collaborations.

A strategic partnership rooted in mutual interest

The UAE’s commitment is not merely an economic windfall; it’s a geopolitical statement. Historically, Gulf nations have funneled vast sums into Western markets to diversify their oil-dependent economies and secure long-term influence. However, this latest investment signals a deliberate alignment with the United States — particularly under Trump’s leadership — amid rising global tensions with China and Russia.

“These significant investments underscore the close ties between the United States and the United Arab Emirates,” the White House declared in its official statement. The sentiment was echoed by Sheikh Tahnoon, who “praised President Donald Trump’s leadership and economic policies, noting their significant role in stimulating foreign direct investment and fostering robust economic partnerships.”

The UAE’s confidence in the U.S. economy is no accident. Since Trump’s return to the White House in 2025, his administration has aggressively pursued deregulation, tax incentives and energy independence — policies that have reinvigorated foreign investor confidence.

Key investments fueling American growth

Among the most notable deals under the $1.4 trillion framework:

- $25 billion for energy and data infrastructure: UAE investment fund ADQ, alongside U.S. firm Energy Capital Partners, will pour capital into energy projects and data centers, bolstering America’s digital and power grids.

- Expansion in natural gas and low-carbon solutions: XRG, the investment arm of UAE state oil giant ADNOC, will back U.S. natural gas production and exports, including a major stake in Texas’ NextDecade LNG facility. The firm also plans investments in “gas, chemicals, energy infrastructure and low-carbon solutions.”

- Domestic aluminum production boost: Emirates Global Aluminum will finance a new U.S. smelter, potentially doubling domestic aluminum output — a critical move for both defense and manufacturing supply chains.

Additionally, Emirati billionaire Hussain Sajwani has pledged $20 billion for data centers across the Midwest and Sunbelt, targeting states like Arizona, Texas and Ohio — regions that have thrived under Trump’s economic policies.

Why this deal matters now

The timing of this announcement is significant. With China aggressively expanding its global influence through initiatives like the Belt and Road Initiative, the UAE’s pivot toward the U.S. sends a clear message: America remains the world’s most reliable economic partner.

Moreover, the investment aligns with Trump’s long-standing “America First” agenda. By channeling foreign capital into domestic industries rather than allowing it to flow overseas, the administration ensures that American workers and businesses reap the benefits.

Critics may question the lack of full transparency regarding all aspects of the deal, but supporters argue that strategic discretion is necessary in high-stakes diplomacy. As Trump noted on Truth Social, the discussions with UAE leaders focused on “the advancing of our economic and technological futures” — a vision that appears to be materializing at an unprecedented scale.

Conclusion: A win for American prosperity

The UAE’s $1.4 trillion commitment is more than just an economic boost — it’s a testament to the success of Trump’s pro-business, pro-growth leadership. In an era of global uncertainty, this partnership reaffirms America’s position as the world’s premier destination for investment and innovation.

As the details of these deals unfold, one thing is certain: The Trump administration’s economic strategy is paying off — big time.

Sources include:

Submit a correction >>

Tagged Under:

AI, big government, Bubble, China, Donald Trump, economic riot, economy, energy, finance riot, foreign relations, future tech, investment, money supply, natural gas, oil, power, power grid, progress, risk, Russia, UAE, White House

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2018 MONEYSUPPLY.NEWS

All content posted on this site is protected under Free Speech. MoneySupply.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. MoneySupply.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.