Crypto stocks PLUMMET: Industry nearing collapse as financial analysts warn most crypto firms unlikely to survive long-term

12/06/2022 / By Arsenio Toledo

Stocks for companies in the cryptocurrency industry have plummeted. Analysts and investors still can’t figure out when this downfall will bottom out, but many of them believe that most crypto firms are unlikely to survive long-term.

Publicly-traded cryptocurrency companies like Coinbase Global Inc., Galaxy Digital Holdings Ltd. and MicroStrategy Inc. all had their stocks plummet in value by more than 25 percent in November.

The declines of these three largest publicly-traded crypto firms added to the pain of a very dismal year for the crypto industry. While they rallied during the early part of the week beginning on Dec. 5, their combined shareholder value is still down $52 billion since the beginning of the year.

Few, if any, companies connected to the crypto industry have been spared during this downturn. Banks like Silvergate Capital Corp. and Signature Bank have taken hits. Mining stocks have become the worst performers, with crypto mining firms like Marathon Digital Holdings Inc. and Hut 8 Mining Corp. both seeing their share prices cut roughly in half during November.

Data shows that November is the worst month for crypto since June, and stocks in crypto are down 63 percent this year.

Cryptocurrency assets have not done well either. Bitcoin, the largest cryptocurrency in the world, plunged by 18 percent in November, its biggest monthly loss in five years. Ether, the native cryptocurrency of the Ethereum blockchain and the second-largest cryptocurrency, fell by 21 percent.

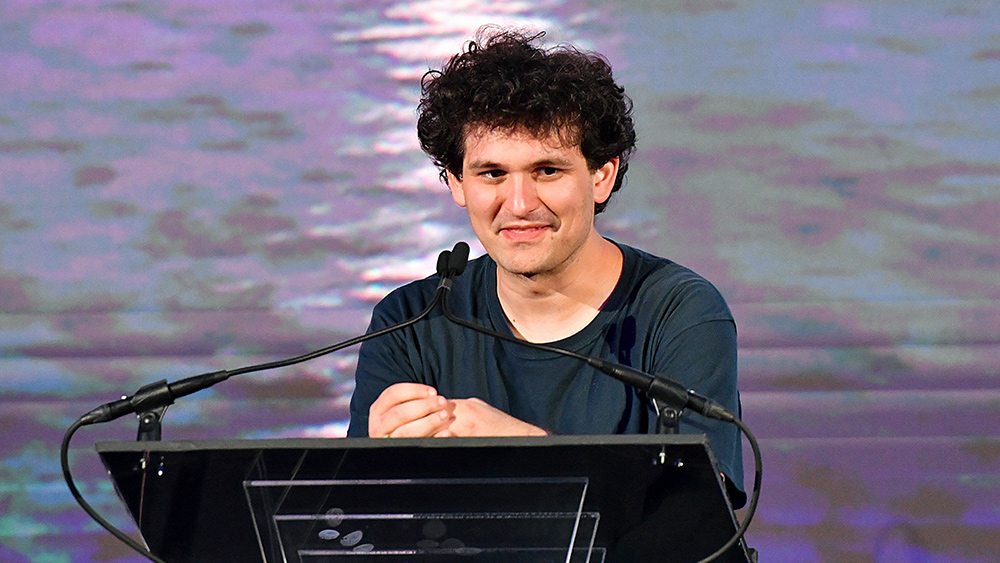

Crypto assets hit the hardest last month were a group of digital assets associated with Sam Bankman-Fried and FTX, known colloquially as “Sam Coins.” These coins were affected either because Bankman-Fried invested in them, was one of the main backers of the coins, or both. (Related: FTX head Sam Bankman-Fried declared a “pathological liar and a sociopath” for continuing to explain away his outrageous fraud and deception.)

One of the hardest hit among these coins was FTT, which tumbled by 90 percent last month, falling from $26 to around $1.

Another crypto asset affected was SOL, the native token of the Bankman-Fried-championed blockchain platform Solana. Last month, SOL dropped in value by 58 percent. Serum, another native token of Solana, fell in value by 70 percent and was last month’s biggest loser among the roughly 160 digital assets in the CoinDesk Market index.

Financial analysts make bleak predictions for crypto’s future

To top off the disaster already gripping the crypto sphere, BlackRock Chief Executive Officer Larry Fink recently said that he expects most crypto companies to collapse in the aftermath of the FTX scandal.

“I actually believe most of the companies are not going to be around,” said Fink during an interview. Fink, a long-time skeptic of cryptocurrencies, is not immune to the fallout of FTX’s collapse.

While BlackRock, the world’s biggest asset manager, will remain standing since it oversees about $8 trillion worth of assets, it did invest roughly $24 million in FTX through a vehicle called a fund of funds. The company will likely not see a return on this investment.

Despite his skepticism regarding cryptocurrency’s long-term viability, Fink, 70, said he still sees potential in the technology underlying crypto, notably blockchain, instant settlement of securities and simplified shareholder voting.

Chase White, an analyst at investment firm Compass Point Research and Trading, wrote in a note to clients that its near-term projections for the crypto industry are dismal.

“We expect the crypto space to continue to be toxic for investors in the near-term and expect overall chain activity to be relatively quiet among users as we continue to wait out potential contagion effects as a result of the bankruptcy of FTX,” White wrote.

Learn more about the collapse of cryptocurrencies at BitcoinCrash.news.

Watch this clip from InfoWars featuring attorney Robert Barnes, who calls the FTX scam as the biggest political scandal in history.

This video is from the InfoWars channel on Brighteon.com.

More related stories:

World’s largest bitcoin trust refuses to share proof of reserve audit.

FTX contagion spreads as BlockFi crypto firm files for Chapter 11 bankruptcy.

FTX collapse fallout: Crypto brokerage firm Genesis warns of possible bankruptcy.

Crypto exchange platform Coinbase lost around 85% of its value in one year.

Crypto.com withdrawals SURGE after CEO admits “mishandling” $400M transaction.

Sources include:

Submit a correction >>

Tagged Under:

BlackRock, Bubble, chaos, Collapse, crypto cult, cryptocurrency, cryptocurrency collapse, currency crash, debt bomb, debt collapse, finance, financial crash, FTX, Larry Fink, market crash, money supply, risk, Sam Bankman-Fried, stocks

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2018 MONEYSUPPLY.NEWS

All content posted on this site is protected under Free Speech. MoneySupply.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. MoneySupply.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.