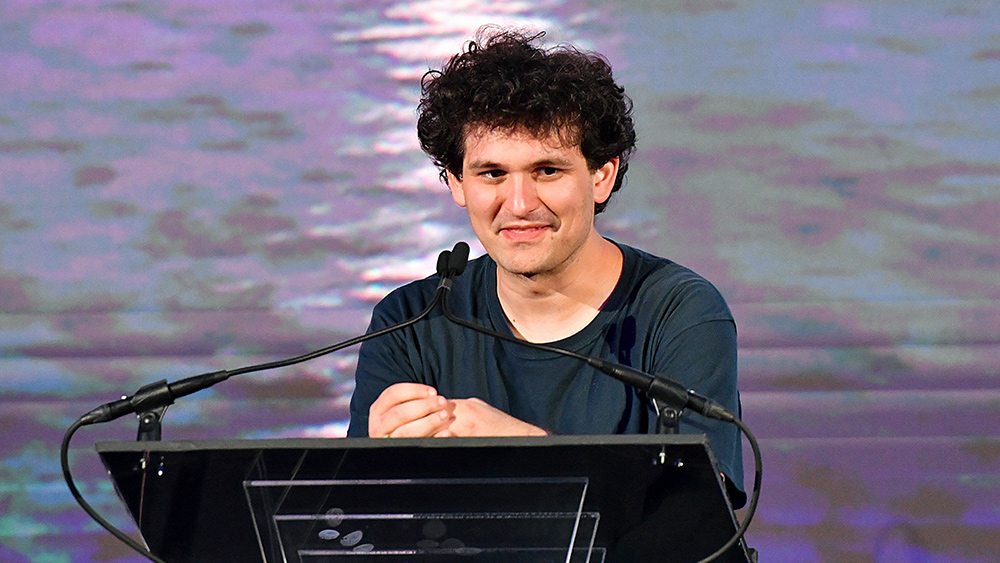

SEC to file additional charges against accused crypto fraudster and FTX boss Sam Bankman-Fried

12/16/2022 / By JD Heyes

As much trouble as Sam Bankman-Fried, the alleged crypto-fraudster and former CEO of now-defunct FTX, is in, thanks to charges being filed against him by the Justice Department, it’s not over yet for him.

Now, the Securities and Exchange Commission is preparing to file additional charges against the accused thief and big-time Democratic donor, according to Wednesday reports.

Besides seeking to ban SBF from the cryptocurrency industry permanently, the SEC will also charge him with “orchestrating a scheme to defraud equity investors in FTX,” charges that necessarily include conspiracy, which — if he’s found guilty — will only lengthen his jail term, according to a press release.

“Investigations as to other securities law violations and into other entities and persons relating to the alleged misconduct are ongoing,” the press release stated, adding:

According to the SEC’s complaint, since at least May 2019, FTX, based in The Bahamas, raised more than $1.8 billion from equity investors, including approximately $1.1 billion from approximately 90 U.S.-based investors. In his representations to investors, Bankman-Fried promoted FTX as a safe, responsible crypto asset trading platform, specifically touting FTX’s sophisticated, automated risk measures to protect customer assets.

The complaint alleges that, in reality, Bankman-Fried orchestrated a years-long fraud to conceal from FTX’s investors (1) the undisclosed diversion of FTX customers’ funds to Alameda Research LLC, his privately-held crypto hedge fund; (2) the undisclosed special treatment afforded to Alameda on the FTX platform, including providing Alameda with a virtually unlimited “line of credit” funded by the platform’s customers and exempting Alameda from certain key FTX risk mitigation measures; and (3) undisclosed risk stemming from FTX’s exposure to Alameda’s significant holdings of overvalued, illiquid assets such as FTX-affiliated tokens.

The complaint further alleges that Bankman-Fried used commingled FTX customers’ funds at Alameda to make undisclosed venture investments, lavish real estate purchases, and large political donations.

SEC Chairman Gary Gensler provided additional details surrounding his agency’s enforcement against SBF.

“We allege that Sam Bankman-Fried built a house of cards on a foundation of deception while telling investors that it was one of the safest buildings in crypto,” he said, according to the press release. “The alleged fraud committed by Mr. Bankman-Fried is a clarion call to crypto platforms that they need to come into compliance with our laws.

“Compliance protects both those who invest on and those who invest in crypto platforms with time-tested safeguards, such as properly protecting customer funds and separating conflicting lines of business. It also shines a light into trading platform conduct for both investors through disclosure and regulators through examination authority. To those platforms that don’t comply with our securities laws, the SEC’s Enforcement Division is ready to take action,” Gensler noted.

Gurbir S. Grewal, Director of the SEC’s Division of Enforcement, added: “FTX operated behind a veneer of legitimacy Mr. Bankman-Fried created by, among other things, touting its best-in-class controls, including a proprietary ‘risk engine,’ and FTX’s adherence to specific investor protection principles and detailed terms of service. But as we allege in our complaint, that veneer wasn’t just thin, it was fraudulent.”

“FTX’s collapse highlights the very real risks that unregistered crypto asset trading platforms can pose for investors and customers alike,” Grewal noted further. “While we continue to investigate FTX and other entities and individuals for potential violations of the federal securities laws, as alleged in our complaint, today we are holding Mr. Bankman-Fried responsible for fraudulently raising billions of dollars from investors in FTX and misusing funds belonging to FTX’s trading customers.”

In addition to the SEC and Justice Department charges, Bankman-Fried also faces charges from the Commodity Futures Trading Commission. SBF is charged with violating anti-fraud provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934.

Sources include:

Submit a correction >>

Tagged Under:

Alameda, Bahamas, big government, Bubble, conspiracy, corruption, criminal charges, crypto fraud, cryptocurrency, deception, fraud, fraudulent, FTX, Justice Department, money supply, risk, Sam Bankman-Fried, scam, SEC

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2018 MONEYSUPPLY.NEWS

All content posted on this site is protected under Free Speech. MoneySupply.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. MoneySupply.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.