Jay Dyer: FTX scam no different from how Federal Reserve prints money and assigns it value

11/23/2022 / By Arsenio Toledo

As cryptocurrency exchange FTX continues to collapse, Jay Dyer of “Jay’sAnalysis” podcast makes it clear that this is exactly how the Federal Reserve runs the economy of the United States.

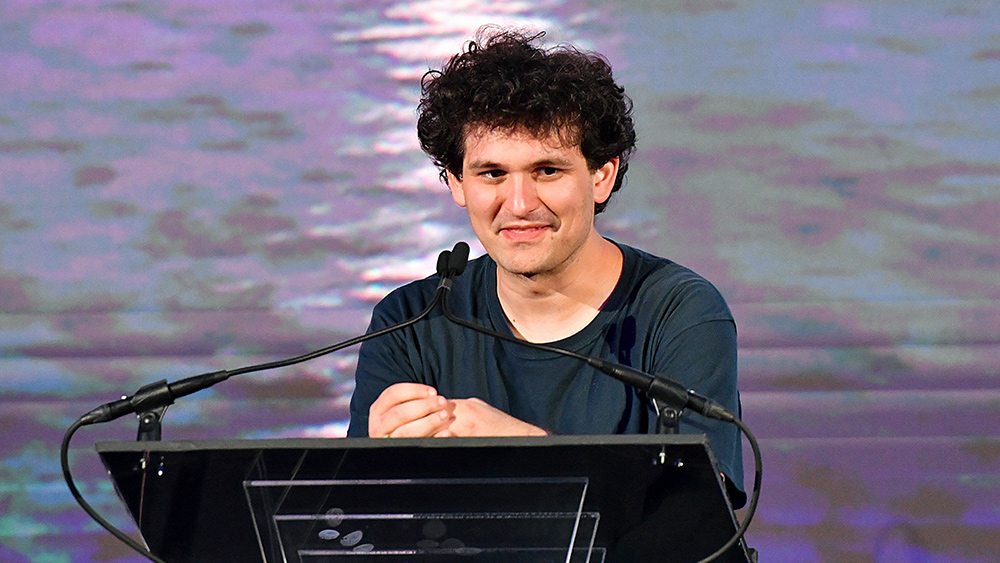

Serving as a guest host in an episode of “The Alex Jones Show” on InfoWars, Dyer compared how the FTX accumulated value and collapsed to how the Fed itself is seen and operates. (Related: Democrats SCRAMBLING to hide evidence linking them to former FTX CEO Sam Bankman-Fried.)

“This is no shocker. Because as I’m listening to everybody talking about it, [they say] ‘It’s a Ponzi scheme, it’s a rug pull, there’s nothing behind the tokens, it’s fiat, they’re taking all the money.’ That’s exactly how the Federal Reserve works,” he said.

“It’s like, everybody’s shocked? Well, wait till you find out that the Federal Reserve is the same scam system. It’s a giant rug pull Ponzi scheme.”

Dyer further pointed out that the way cryptocurrency works is perfectly modeled on the Federal Reserve and how it uses fiat currency to gauge value. He claimed that cryptocurrencies are just an easier way to “mask the scam.”

He said cryptocurrency companies did this by selling people the idea behind the Federal Reserve model.

“‘Oh, let’s just put that into crypto. Do the exact same thing where we can print up infinite amounts of digits on the screen and just say yeah well there’s a zillion [fake tokens] and we’ll just keep inflating the price of the fake coin,'” he said. “And so, people invest… It’s obvious that this is just the exact same model of the Federal Reserve scam.”

Fed using FTX scandal to push through its own digital currency plans

The Federal Reserve Bank of New York is using the commotion with FTX to push forward with its own “digital dollar” pilot program, in collaboration with almost a dozen banks and other major financial institutions.

In a Nov. 15 announcement, the New York Fed said the 12-week proof-of-concept pilot program would explore the feasibility of an “interoperable network of central bank wholesale digital money and commercial bank digital money operating on a shared multi-entity distributed ledger.”

The program is being led by the New York Fed’s Innovation Center (NYIC). The project will test the “technical feasibility, legal viability and business applicability” of “distributed ledger technology,” or blockchain. The project will also test the use of simulated digital assets and explore regulatory frameworks for using these assets.

Partner institutions include Bank of New York Mellon, Citigroup, HSBC Holdings, Mastercard, PNC Financial Services Group, Toronto-Dominion Bank, Truist Financial, US Bancorp and Wells Fargo.

“The NYIC looks forward to collaborating with members of the banking community to advance research on asset tokenization and the future of financial market infrastructures in the U.S. as money and banking evolve,” said NYIC Director Per von Zelowitz in a statement.

If the test is successful, the NY Fed is planning another project testing the feasibility of multiple central bank digital currencies interacting alongside a select number of regulated stablecoins, or cryptocurrency assets that have their value pegged against a traditional asset.

Read more news about the FTX debacle at BitRaped.com.

Watch this full episode of “The Alex Jones Show” on InfoWars featuring guest host Jay Dyer discussing the similarities between the FTX scandal and how the Fed runs the U.S. economy.

This video is from the InfoWars channel on Brighteon.com.

More related articles:

Feds introducing ‘digital’ currency that government can ‘program’ to control individual behavior.

Crypto 9/11 is now under way… a “controlled demolition” event to usher in HEAVY regulation.

Sources include:

Submit a correction >>

Tagged Under:

Bubble, Central Bank Digital Currency, central banks, computing, conspiracy, corruption, crypto crash, crypto cult, cryptocurrency, deception, deep state, economy, Federal Reserve, finance, financial crimes, FTX, money supply, risk, scam

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2018 MONEYSUPPLY.NEWS

All content posted on this site is protected under Free Speech. MoneySupply.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. MoneySupply.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.