China’s economy showing signs of FAILING as exports slow down, shipping industry weakens

09/13/2022 / By Arsenio Toledo

Chinese exports are slowing down and the country’s shipping industry is weakening – ominous signs that the country’s economy is failing.

On Wednesday, Sept. 7, the Chinese government released a report showing that exports rose 7.1 percent year-over-year in August. This is far below the consensus forecast predicting a 12.8 percent growth in exports. This is also far below the 18 percent year-over-year growth in exports in July. (Related: Growth in Taiwanese exports slows to a trickle, raising alarms of global economic slowdown.)

China’s exports to the United States, the country that receives the most Chinese goods, declined by 3.8 percent year-over-year in August, compared to an 11 percent increase in July.

Exports to China’s other trading partners also decreased in August. Year-over-year export growth to the European Union only increased by 11.1 percent, compared to 23.2 percent in July.

Exports are an important factor in China’s economic growth. During the early stages of the pandemic and the ensuing economic turmoil brought about by lockdowns, China was able to keep itself afloat thanks to the massive volume in sales of containerized goods to Europe and the United States.

Shipping volumes out of China decreasing

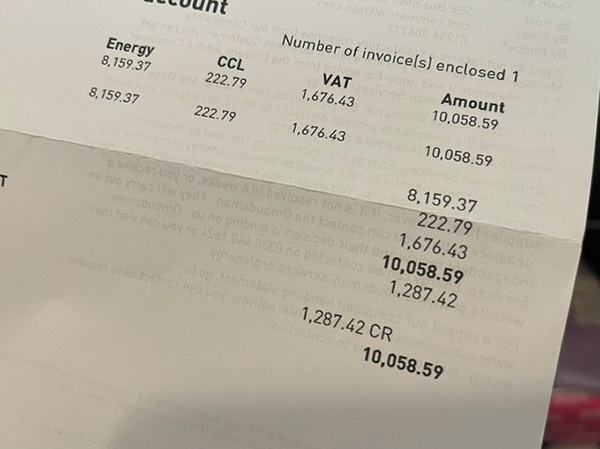

The spot rate for sending a standard 40-foot shipping container from Asia to the West Coast of the U.S. dropped in value by 20 percent to $4,345 in the first week of September. It is also 79 percent cheaper than the same time last year.

“This decrease reflects falling demand for freight, both because of excess inventories among some importers as inflation reduces spending among some consumers, and as others shift to other types of goods and to services as the pandemic recedes,” noted Judah Levine, head of research for Freightos Baltic Index. He added that many retailers have already purchased and stored peak season orders earlier this year to avoid the rampant delays experienced last year.

According to the World Container Index, an index of spot freight rates released by maritime research consultancy Drewry, freight rates from Shanghai to Los Angeles for 40-foot containers dropped by 14 percent to $4,782. Drewry analysts further noted that the index will likely continue decreasing in the next few weeks.

Spot rates for 40-foot containers from Asia to northern Europe also fell last week after several months of stable prices. Levine noted how this is a reflection of how demand and volumes are decreasing all over the world.

Luna Sun and Ji Siqi, writing for South China Morning Post, noted that high global inflation and surging energy prices following the outbreak of the war in Ukraine are two of the main reasons why external demand for Chinese goods is decreasing.

Diminishing demand, economic uncertainties, a slumping real estate market and weakened consumer spending are all pointing toward a possible recession in China.

Hong Hao, chief economist of Chinese hedge fund Grow Investment, noted that there is no doubt in the minds of most financial experts that China’s exports will keep slowing down and that it is unlikely to recover in the near term.

“The turning point has already come,” said Hong.

Learn more about the global economy at MarketCrash.news.

Watch this episode of “The Prophecy Club” as host Pastor Stan Johnson discusses how shipping coming in from China may contain weapons, including missiles.

This video is from the High Hopes channel on Brighteon.com.

More related stories:

America has imported over $6 billion worth of goods from Russia since the start of Ukraine invasion.

China’s live-fire military exercises in Taiwan Strait pose threat to global economic activities.

Port of Los Angeles director: US supply chain at risk if rail service does not improve.

Sources include:

Submit a correction >>

Tagged Under:

Bubble, China, Chinese economy, Collapse, debt bomb, debt collapse, economic collapse, economy, exports, inflation, market crash, money supply, recession, risk, shipping, shipping industry, supply chain, trade

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2018 MONEYSUPPLY.NEWS

All content posted on this site is protected under Free Speech. MoneySupply.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. MoneySupply.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.