Oil wipe out sees prices plunge -220% to -$37 / barrel… ECONOMIC WARFARE has been unleashed against America

04/20/2020 / By Mike Adams

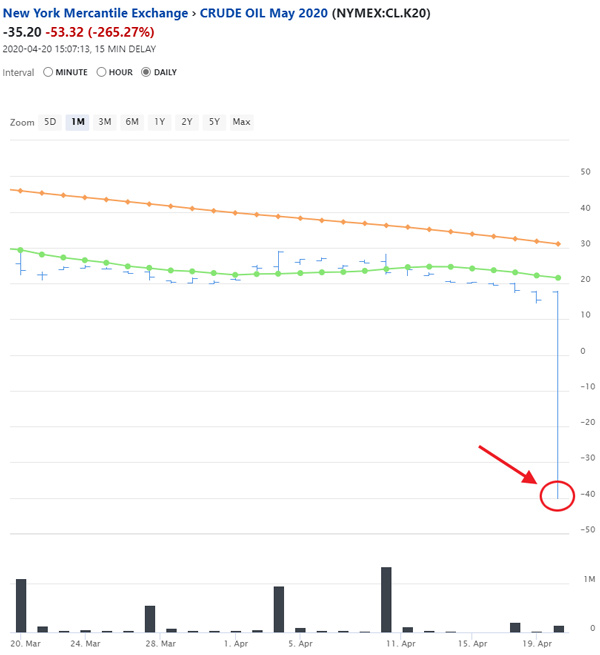

Something happened today that will never happen again in your lifetime. Crude oil just plunged from over $20 / barrel down to -$37 / barrel in a matter of a couple of hours. This means oil companies must now pay others to haul away their oil.

The economic ramifications of this truly cannot be overstated. This could be a “global extinction” scale event when it comes to western finance and the debt-based banking infrastructure which has enormous exposure to oil derivatives and commodities leverage.

The first wave of impacts from this will be mass bankruptcies and unemployment across the energy sector, strongly affecting states like Texas, which derives a very large portion of its revenues from the energy sector.

Next, the wave of economic destruction will ripple through the financial sector in the days ahead, shredding anyone who had placed bets (derivatives, options, etc.) that counted on oil staying over $20 / barrel. Expect to see a large number of trading firms, hedge funds and institutional investors suffer extraordinary losses that no mathematical model could have predicted. (Today is another “black swan” event that financial models never anticipate.)

But it won’t stop there. There is significant counter-party risk in the oil finance sector, and with a price plunge this radical, counter-parties that are required to pay up on the losing side of the market bets are going to be annihilated. Many will implode into bankruptcy this week.

The counter-party failures may set into motion a cascading domino-effect of financial collapse which could ensnare banks and other large financial institutions, eventually setting off a “contagion” of exponential spread of other failures which might snowball into an unfathomable systemic collapse of financial institutions. This is especially true if another major blow to the global financial system hits this week, such as China announcing a selloff of U.S. Treasury debt (or someone announcing a new gold-backed currency).

Because the risk of all that is very real, we expect President Trump to take aggressive, emergency actions to try to halt the financial collapse contagion and artificially prop up oil prices. The array of actions that the U.S. government might take include: (these are not predictions, but options of different scenarios)

- Government price controls on oil.

- Very high tariffs on imported oil in order to maintain a minimum of $20 / barrel.

- Possible nationalization of the oil industry so that financial risk is transferred to the government itself. (And why not, since the entire U.S. economy has now been taken over by the Fed in a Soviety-style economic coup.)

- Government leasing of oil tankers to sit off shore and store oil as a way to try to prop up oil prices.

All of these efforts will fail to contain the damage for the simple reason that demand for oil has fallen through the floor due to the economic collapse associated with the coronavirus lockdowns. And this demand isn’t coming back any time soon. However, emergency actions may be able to contain the spread of this disaster to financial institutions, and we expect the bailout bubble boys in Washington D.C. to do everything necessary to protect the banks.

If not quickly reversed, this will wipe out a significant portion of the oil production infrastructure in North America

This plunge into negative prices for oil is already unleashing an exponential wave of bankruptcies and financial fractures across America’s financial landscape. If prices stay at anything under $20 / barrel for very long, a significant portion of North America’s oil producing infrastructure will be annihilated beyond recovery.

The oil field equipment will be sold off, the employees who are fired will scatter and find other work, and the investors will be found dead after leaping off tall buildings. Beyond a certain point, you can’t just jolt the oil infrastructure back to life. Once complex oil field operations have been shuttered, resuscitation is impossible and you have to start the project over from scratch.

That’s why we believe these price fluctuations are part of a global economic war against the United States of America being waged by strategic enemies such as Russia. Even Saudi Arabia, a US ally, has strong economic reasons to crush the North American oil production infrastructure so it can corner a large part of the future market for high-priced oil.

Once North American oil production capacity has been crushed, the surviving oil producers will acquire increased market share as the post-coronavirus economic gets back on track, resulting in long-term oil shortages which will produce extremely high prices (and profits) for those nation states which can survive this financial extinction event.

In the long run oil will skyrocket and this event will be highly inflationary, not deflationary

The long-term upshot of all this will be highly inflationary, with oil heading over $150 / barrel at some future date as the post-coronavirus economy surges back. Gasoline at the pump will be headed toward $5 / gallon, and the profits from this squeeze will flow into Russia, Saudi Arabia and perhaps nations like Venezuela and Ecuador, where oil deposits are enormous (and largely controlled after by communist China).

Gold mining is also about to surge into new profitability, since between 20-30% of gold mining operations costs are oil. Any gold mining company that can still function will reap huge profits, especially as gold demand continues to soar.

Depending on how Trump handles this, the USA may end up seeing a very large portion of its domestic oil production capacity destroyed, which would be horrific for national security, as the nation would need to depend on oil imports for the foreseeable future, making America highly vulnerable to threats and price gouging from oil-producing nations. This helps explain why the USA has been so fervently working to overthrow the socialist leader of Venezuela. It’s about getting our hands on that nation’s oil production as well as the precious metals and rare earth minerals that Venezuela commands.

The risk of global warfare just leaped higher today, as geopolitical and economic tensions are now at a feverish level. Anything could break wipe open at any moment… and yes, China did release the bioengineered Wuhan coronavirus as a weapon system against the West. It was just phase one in their attack against the West, as J.R. Nyquist explains:

Stay informed. Read NewsTarget.com for daily coverage of geopolitics and finance.

Tagged Under: Bubble, Collapse, crash, deflation, economy, energy, geopolitics, inflation, national security, oil, President Trump, risk, Russia, Saudi Arabia, Wall Street, World War III

RECENT NEWS & ARTICLES

COPYRIGHT © 2018 MONEYSUPPLY.NEWS

All content posted on this site is protected under Free Speech. MoneySupply.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. MoneySupply.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.