America about to suffer as Federal Reserve struggles to battle inflation

04/05/2022 / By Kevin Hughes

The worst inflation in four decades has spurred the Federal Reserve to start a series of interest rate hikes.

It’s not going to work. The plain truth is that the Federal Reserve doesn’t know how to battle inflation and America is about to suffer the consequences.

With prices soaring at a pace not seen since the early 1980s, no one disputes that inflation is currently a critical problem. Motorists now fear going to the gas pump while shoppers prepare themselves for sticker shocks.

America’s central bank and a large number of economists have long accepted the idea that controlling interest rates can keep the economy working well with inflation recording at a low rate of two percent or less.

Previous performance is barely encouraging. For example, the Federal Reserve increased the value of money in the late 1990s. The outcome was a recession and a bear market that reduced equity values nearly in half. (Related: Federal Reserve expected to raise interest rates earlier than expected due to rapid inflation.)

This was followed by the contradictory course, slashing rates and severely decreasing the value of the dollar. This led to a shocking commodities boom and the housing bubble. And Americans all know how that ended up.

And what the Federal Reserve does with interest rates is the same as rent controls but with the money being rented instead of apartments, houses or other properties. The only question now is how much damage the Federal Reserve does with a specific plan of action.

Currency devaluation, lockdowns cause inflation

There are two kinds of inflation, with the first and traditional one being the devaluation of a currency such as the dollar. The Federal Reserve started making excessive amounts of money in 2018. With the gold price going up 50 percent, the dollar lost value and trouble was approaching.

The pandemic lockdowns came and it triggered the other type of inflation, which is prices soaring due to non-monetary factors such as the government increasing costs through regulations or a drought.

The U.S. and nearly all other nations responded to the Wuhan coronavirus (COVID-19) in early 2020 by shutting down a huge part of their economies, seriously hampering endlessly intricate supply chains all over the world.

Washington shelled out trillions of dollars in emergency relief but it was clear by the end of 2020 that the spending was excessive.

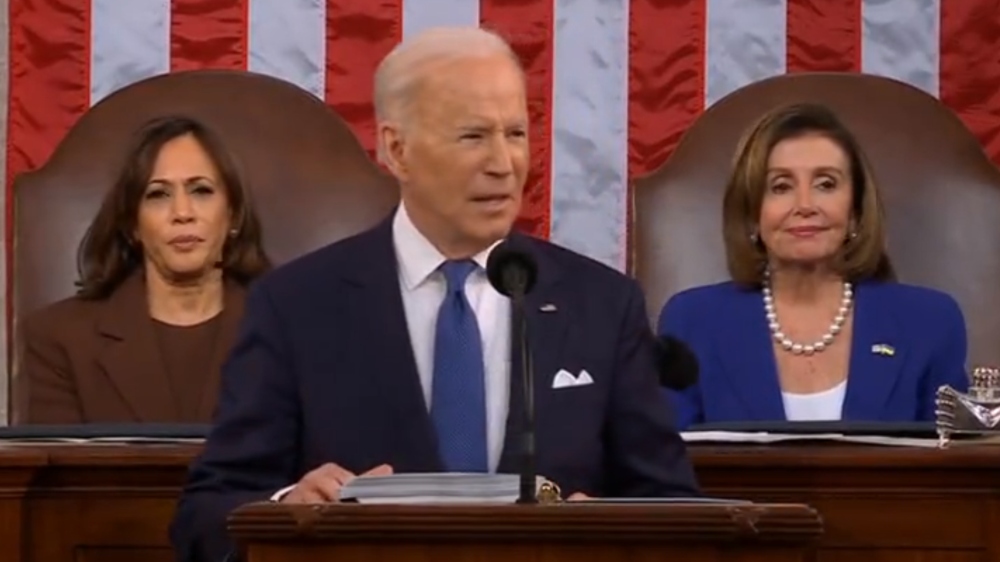

Nevertheless, the Joe Biden administration pushed for even more spending. Expenses would have been far worse if Congress hadn’t stopped Biden’s Build Back Better bill the flood of federal.

With lots of money, a disrupted supply and prices going up, the Federal Reserve responded by making even more money out of nowhere and carelessly bought $120 billion of bonds every month.

And lately the Federal Reserve has been funding a large part of America’s record deficits.

The Federal Reserve has made a destructive time bomb by using a trick to keep majority of its new money from overflowing the economy. With the bond buying, it was able to make money. However, the Federal Reserve has been borrowing that money back from the financial network nearly on a regular basis by using a reverse repurchase agreements or reverse repos.

In February 2020, it owned none of these specific instruments with the current number being an astonishing $1.7 trillion.

The best thing Washington can do right now is to move out of the way and let the free market resolve the disruptions caused by the lockdowns.

Sadly, the Biden administration is causing havoc with the healing process with its war on fossil fuels contributing to rising fuel prices. The U.S. was a net exporter of oil less than two years ago but it’s no longer happening now.

Meanwhile, the Federal Reserve has reacted to soaring inflation by tightening policy with an interest rate hike in March expected to be followed by increases at each of the remaining six meetings this year. Merchandise prices moved up by 1.1 percent for the month, the quickest hike since October 2021, pushed by supply chain backups that have wrecked the economy for most of the pandemic time.

Follow Inflation.news for more stories about inflation in America.

Watch the video below to know why the Federal Reserve is shocked by inflation that it has created on purpose.

This video is from the InfoWars channel on Brighteon.com.

More related stories:

The Federal Reserve hides price inflation, but why?

The Fed invokes first rate hike to “curb inflation” but it’s way too little, too late.

Senior Federal Reserve official says “transitory” inflation is not actually transitory.

Sources include:

Submit a correction >>

Tagged Under:

big government, Bubble, build back better, central bank, chaos, Collapse, covid-19, currency crash, debt collapse, dollar demise, economic collapse, Federal Reserve, inflation, interest rate, Joe Biden, market crash, monetary policy, money supply, risk, Wuhan coronavirus

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2018 MONEYSUPPLY.NEWS

All content posted on this site is protected under Free Speech. MoneySupply.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. MoneySupply.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.